Beef, Poultry & Pork Market Update

3/10/26

Highlights

Beef

Cattle markets pulled back last week as nearby futures slipped on profit‑taking following the Cattle on Feed release and continued pressure from negative packer margins. Despite the softer futures tone, cash cattle traded higher. Steer carcass weights were slightly higher week over week and remain well above last year. Beef production and harvest continued to run below year‑ago levels, reinforcing tightening availability.

Boxed beef cutouts moved sharply higher. Middle meats led gains, with strength across ribeyes and the broader loin complex. End cuts also improved, with chucks and rounds posting firm movement, and the ground beef and trim markets trending higher as well.

Looking ahead, packers continue to manage harvest levels to support the cutout, and that strategy showed up clearly in last week’s performance. Additionally, large out‑front loin sales are expected to add further support to shortloins and striploins into March.

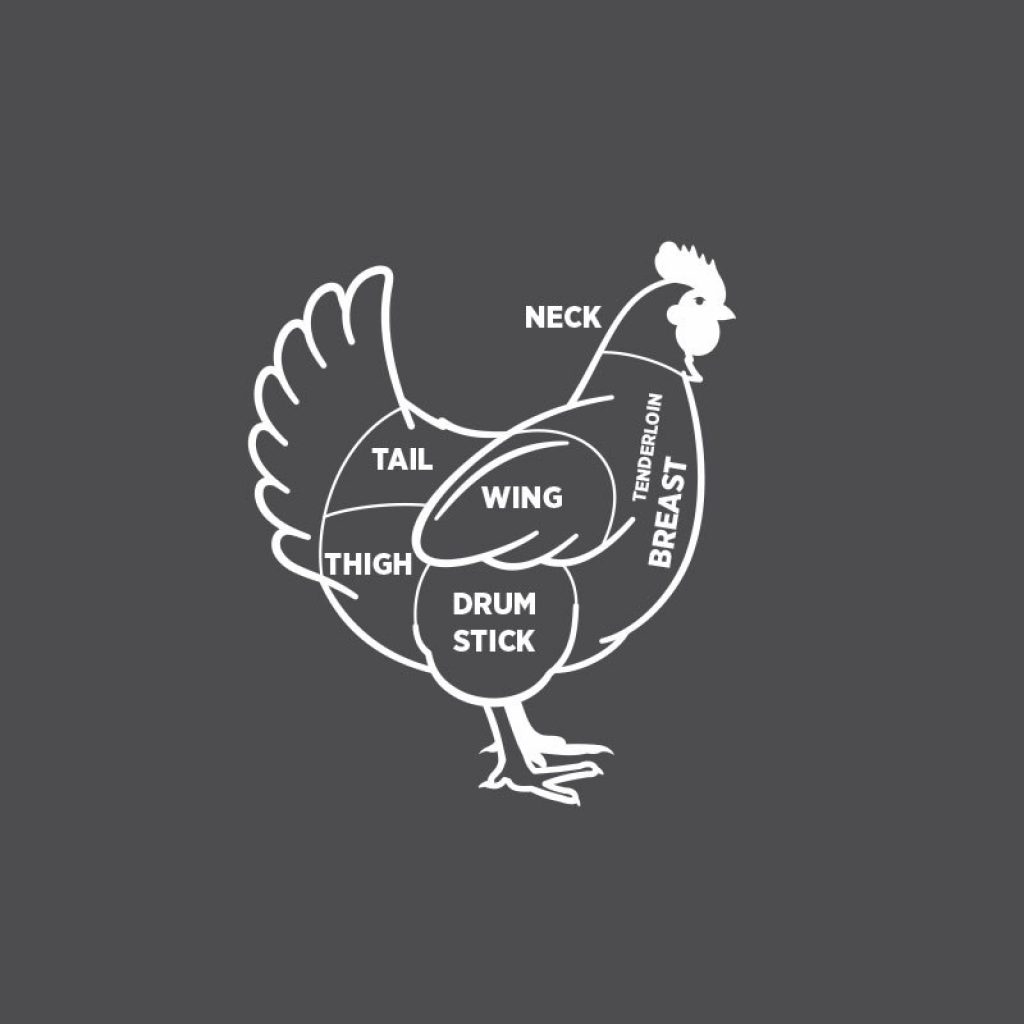

Poultry

USDA young chicken harvest declined week over week but remained higher than the same week last year, while average bird weights were slightly lighter year over year. Overall production stayed above last year’s level. Retail chicken advertisements increased on the week.

Whole bird values were steady overall. The white meat complex was largely unchanged, with breast meat and tenderloins holding flat week over week. Wings eased slightly. Dark meat was mixed to firmer, with drumsticks edging higher and thigh meat continuing to strengthen, while bone‑in thighs held steady.

Looking ahead, the chicken market appears positioned for stable to modestly strengthening conditions into early March. The egg market continues to face downward pressure from abundant supply, though ongoing avian influenza risk remains a volatility factor.

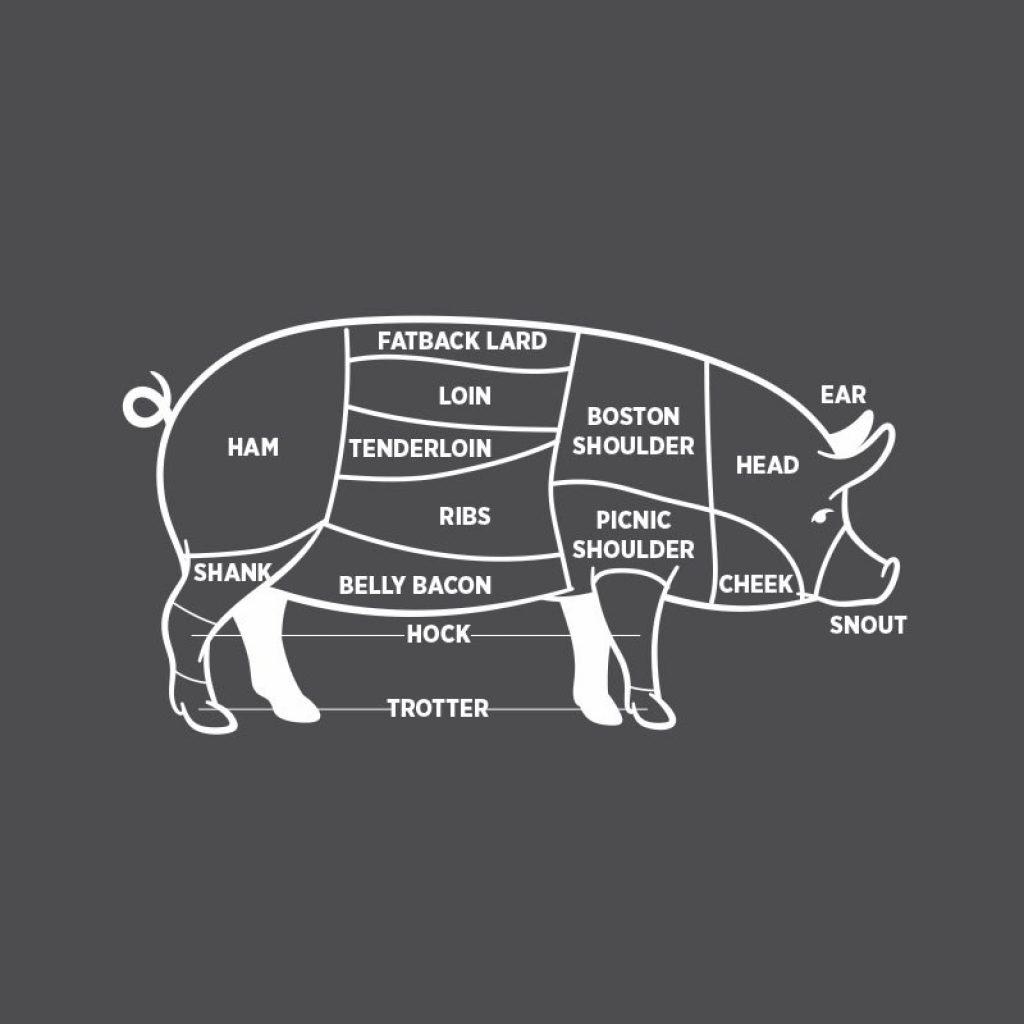

Pork

Hog futures and cash lean hogs strengthened last week, and harvest ran slightly above year‑ago levels. The pork cutout moved higher overall, supported by strength in most primals even as the rib primal lagged.

Within the complex, loins and bellies provided the primary lift. Butts were mostly steady at the subprimal level. Ribs weakened, and hams continued to cool. Trim markets were firmer.

Looking ahead, the cutout remains supported by freezer inventory rebuilding and improving seasonal demand expectations, even as retail movement stays soft. International sales are expected to rebound over the next month and should provide additional support.

Bacon

Belly fundamentals continued to firm this week, with the five‑day USDA averages confirming a controlled upward trend. Despite day‑to‑day volatility, the overall trajectory was higher, signaling steady demand and improving market participation. The broader pork complex reinforced this constructive tone, as supportive loins and trims offset softer ribs, allowing packers to maintain yields without forcing excessive upside in bellies.

From a program standpoint, current conditions favor disciplined coverage strategies. Supply remains adequate but not burdensome, with slaughter and weights sufficient to keep bacon moving while avoiding oversupply. Cold storage levels provide a cushion, reducing near‑term price risk while still allowing for measured appreciation if spring demand accelerates. As a result, the market is positioned to hold value with limited volatility, supporting layered or steady coverage ahead of the seasonal summer demand build.

Chicken

WOGs – Up

Whole Wings – Down

Boneless/Skinless Breasts – Steady

Tenders – Down

Drumsticks – Up

Leg Quarters – Down

Bone‑In Thighs – Up

Boneless/Skinless Thighs – Up

Pork

Bellies – Up

Spareribs – Down

Hams – Down

Loins – Up

Back Ribs – Up

Tenderloins – Up

Butts – Up

Picnic – Up

Cushion – Up

Fat Trim – Up

Lean Trim – Up

Beef subprimals USDA Choice for delivery week of 3/9/26.

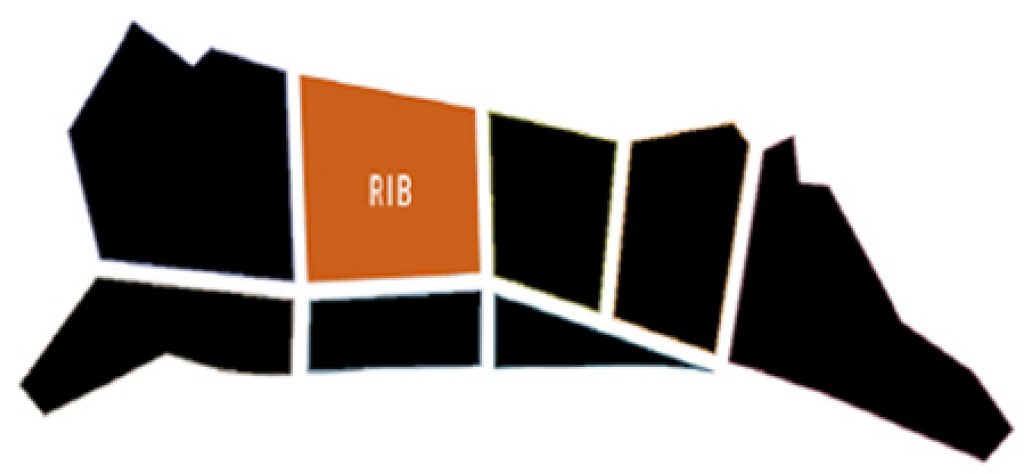

Ribs

Light Lip-on Ribeye – Down

Heavy Lip-on Ribeye – Up

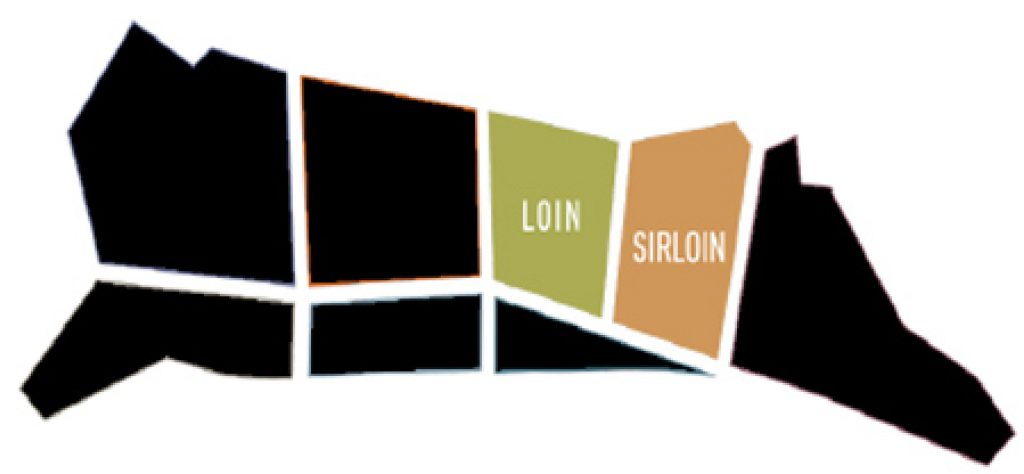

Loins

Striploins – Up

Top Sirloins – Up

Tenderloins – Up

Chucks & Rounds

Shoulder Clod Heart – Up

Shoulder Tenders – Up

Chuck Roll – Up

Top Rounds – Up

Bottom Round Flats – Up

Thin Meats

Briskets – Up

Flap Meat – Up

Ball Tips – Up

Tri Tips – Up

Flank Steak – Up

Outside Skirt – Up

Ground Beef

73% lean – Up

81% lean – Up

Ground Chuck Angus – Up