Beef, Poultry & Pork Market Update

2/24/26

Highlights

Beef

Cattle markets strengthened last week as live cattle futures rebounded following the prior week’s corrective pullback. Cash cattle also moved higher, supported by persistently tight supplies. Steer carcass weights declined week over week but remain well above year‑ago levels. Beef production and harvest continued to run sharply lower than last year, reinforcing ongoing supply constraints.

Boxed beef cutouts were mixed. Within the Choice complex, ribeyes and most of the loin category trended higher, while tenderloins softened. End cuts were mixed, with continued pressure in chuck items offset by firmness in select round cuts. Ground beef markets were mixed.

Looking ahead, historically low harvest levels continue to provide underlying support to boxed beef values despite February typically representing a seasonal low point for demand. Notably, sizable out‑front brisket sales are expected to support the brisket complex in the weeks ahead.

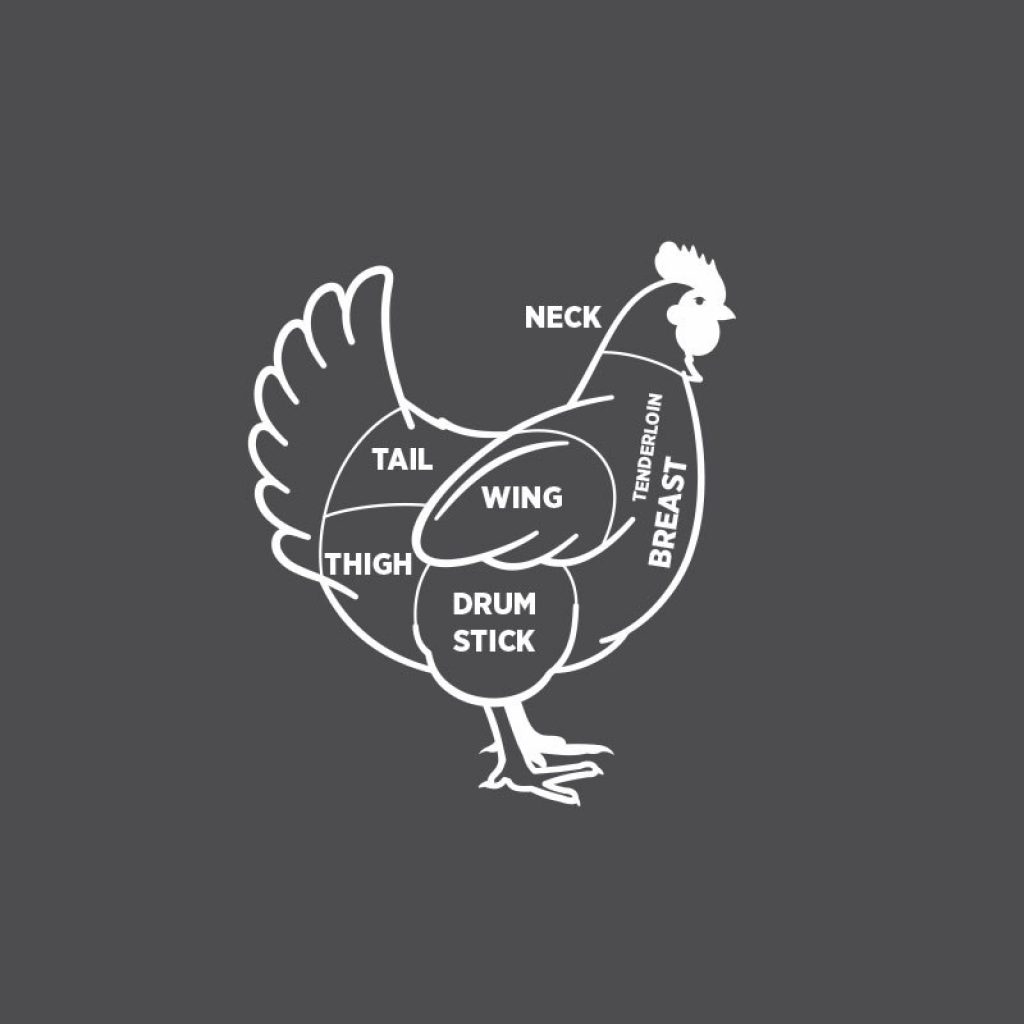

Poultry

USDA young chicken harvest was modestly higher week over week but slightly below year‑ago levels. Average bird weights increased marginally compared to last year, keeping overall production steady. Retail promotional activity declined modestly on the week.

Whole birds firmed slightly. The white meat complex continued to move higher, with breast meat and tenderloins extending recent gains. Wing values also increased. Dark meat performance was mixed, with strength in thighs and leg quarters offset by softness in select wing index measures.

Looking ahead, poultry prices have benefited from seasonal strength and weather‑related supply disruptions in the Southeast. The overall market is expected to hold a modestly firmer tone in the near term.

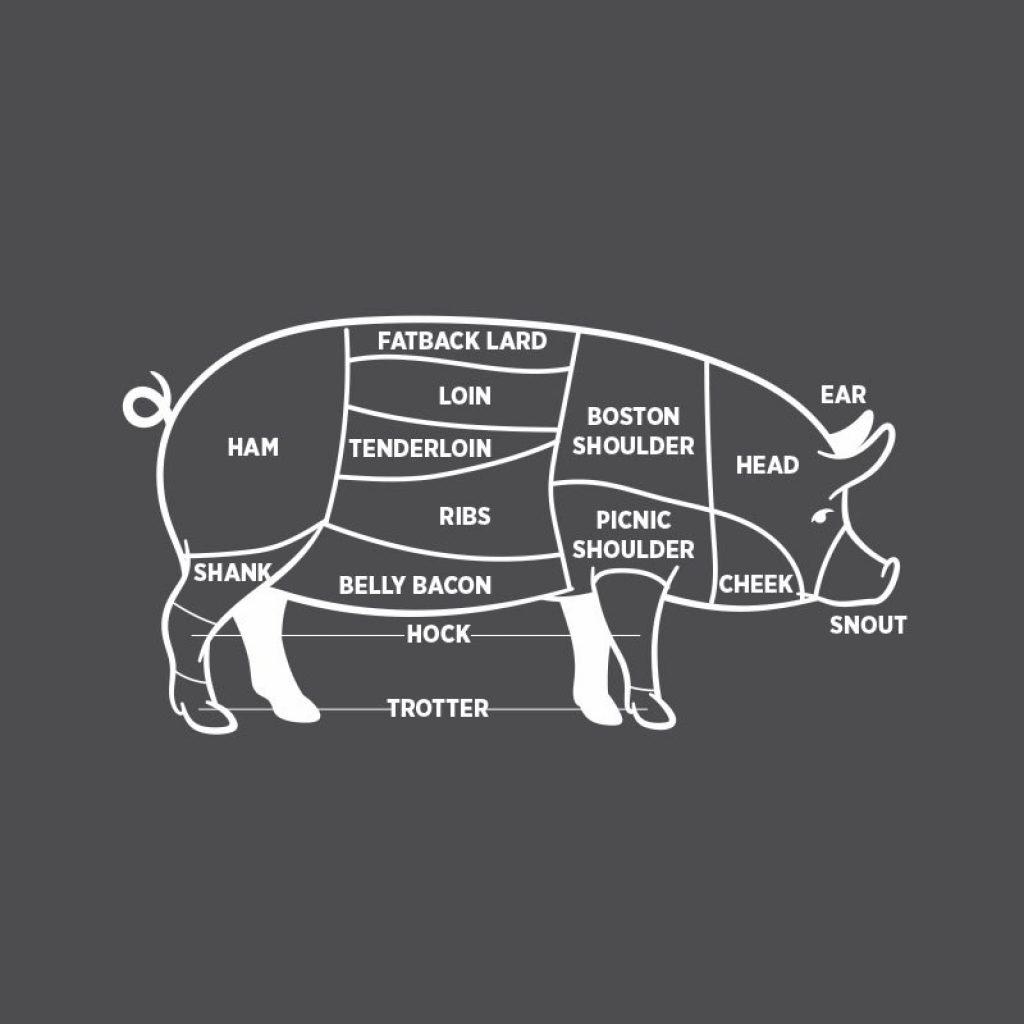

Pork

Hog futures were generally lower last week, while cash markets held relatively steady. Hog harvest ran modestly below year‑ago levels, keeping pork production effectively steady.

The pork cutout edged slightly higher. Loins and bellies provided support, while hams and ribs cooled. Butts were mixed at the subprimal level, and trim values were split between strength in fat trim and softness in lean trim.

Looking ahead, lower harvest volumes and ongoing freezer inventory rebuilding should help keep pork values steady to slightly firmer despite continued softness in retail demand. Improved international interest later in February is expected to provide additional support.

Bacon

Belly fundamentals turned constructive over the five‑day USDA window, with momentum improving into midweek and finishing strongest on Wednesday. The broader pork cutout edged higher, supported by strength in loins and bellies while hams and ribs cooled.

Federally inspected slaughter eased week over week, and carcass weights remained seasonally firm, helping support belly availability at the margin. Cold storage data show a notable rebuild from historically tight levels, but inventories remain within a range that continues to support early‑year belly rallies. With retail features and QSR bacon demand expected to ramp through March, the tone for bellies remains firm to higher barring a material increase in slaughter.

Chicken

WOGs – Up

Whole Wings – Up

Boneless/Skinless Breasts – Up

Tenders – Down

Drumsticks – Up

Leg Quarters – Up

Bone‑In Thighs – Up

Boneless/Skinless Thighs – Up

Pork

Bellies – Up

Spareribs – Down

Hams – Up

Loins – Up

Back Ribs – Up

Tenderloins – Down

Butts – Up

Picnic – Down

Cushion – Down

Fat Trim – Up

Lean Trim – Down

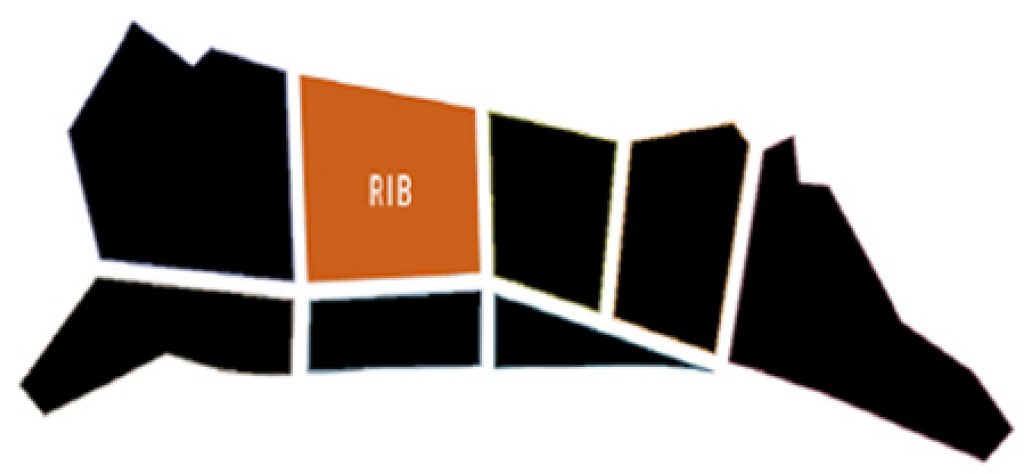

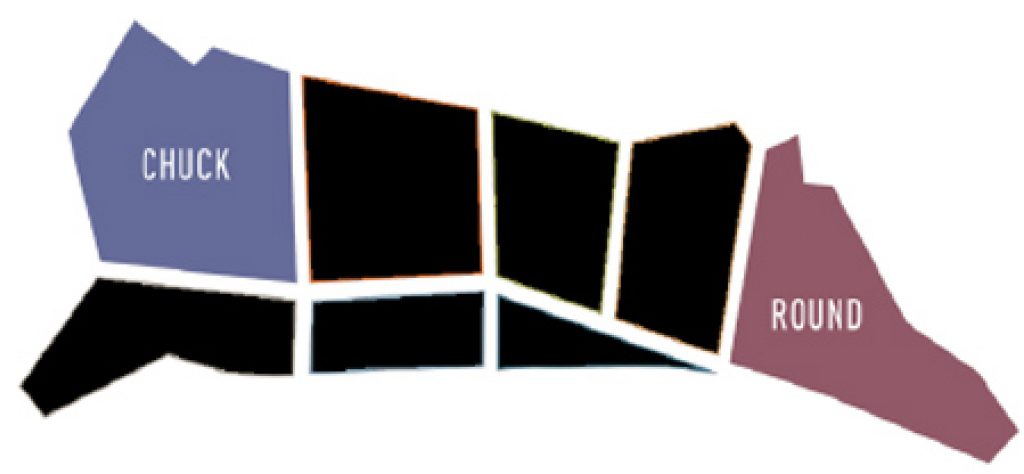

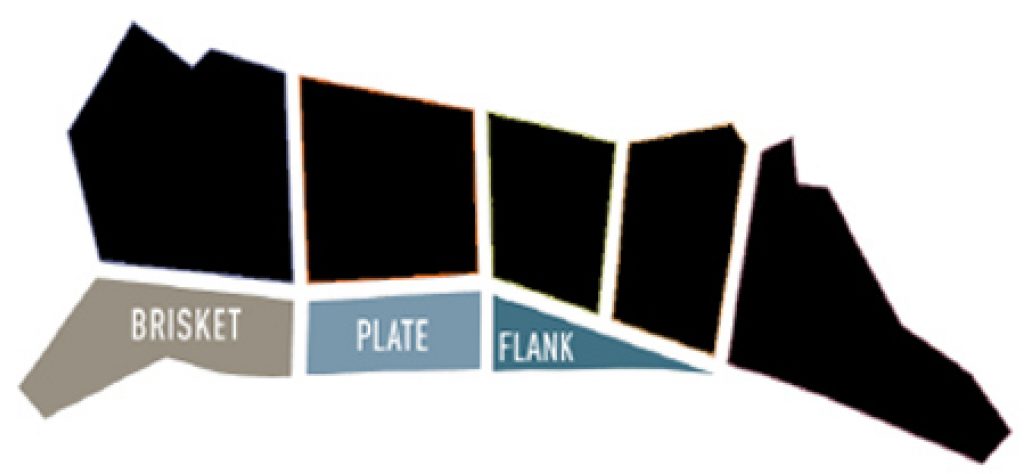

Beef subprimals USDA Choice for delivery week of 3/2/26.

Ribs

Light Lip-on Ribeye – Up

Heavy Lip-on Ribeye – Up

Loins

Striploins – Up

Top Sirloins – Up

Tenderloins – Down

Chucks & Rounds

Shoulder Clod Heart – Down

Shoulder Tenders – Down

Chuck Roll – Down

Top Rounds – Down

Bottom Round Flats – Up

Thin Meats

Briskets – Down

Flap Meat – Down

Ball Tips – Up

Tri Tips – Up

Flank Steak – Up

Outside Skirt – Up

Ground Beef

73% lean – Down

81% lean – Up

Ground Chuck Angus – Steady